Now that tax season is just around the corner, it’s important to make sure your accounting firm is prepared. The best way to get your firm ready for the season is to start preparing early. But how do you know the best way to prep for this busy season?

In this beginner’s guide, we’ll explore some tips and tricks that any size accounting firm can use to get their business ready for tax time. Keep reading to learn all you need to know about prepping for tax season.

Table of Contents

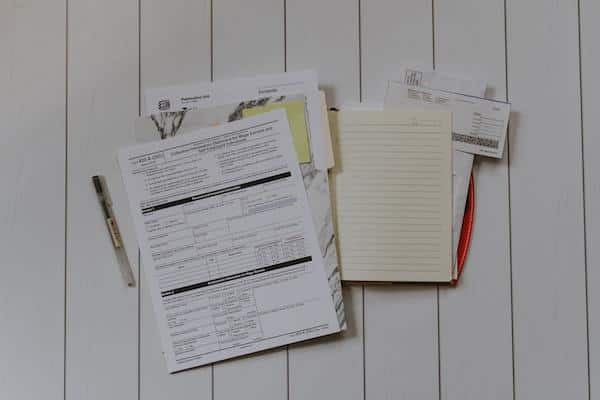

Stay Organized

The first step in preparing your accounting firm for tax season is to stay organized. One great way to do this is by investing in high-quality, custom-made tax folders and envelopes. These items will help keep your clients’ information neatly organized, while also providing branding opportunities for your business.

There are a variety of different types of folders and envelopes to choose from, so be sure to select the ones that will best suit your needs. For example, if you have a lot of clients, you may want to invest in a large number of file folders so that each client’s information can be kept separate.

No matter what type of folders and envelopes you choose, be sure to make the most of their branding potential. You can do this by including your accounting firm’s logo and contact information on the custom tax return folders and envelopes. This will help to ensure that your clients always know where to go when they need to get in touch with you.

By following these tips, you can help ensure that your accounting firm is organized ahead of tax season. Not only will this make the process easier for you and your team, but it will also help to keep your clients happy and organized.

Ensure Your Software Is Up-to-Date

The tax code is always changing, and the software you use to prepare taxes must be up to date to ensure you’re compliant. Many software providers release updates to their software in the fall so it’s ready for the new tax year. Make sure you’re taking advantage of these updates, as they often include new features and tax updates.

If you’re using an older version of your software, you may be missing out on important updates that could save you time and money filing clients’ taxes. Additionally, using an outdated version of your software could leave you vulnerable to penalties from the Internal Revenue Service (IRS) for not using a compliant version. Finally, software updates can help protect your firm from potential security threats.

To ensure your software is up-to-date, check with your provider to find out when the last update was released. If it has been a while since the update was released, you may want to consider upgrading to the latest version.

So make sure to double-check that your software is up-to-date and ready for tax season before you get too busy. This will help ensure that you can focus on providing the best possible service to your clients.

Tracking Client Information

Another vital aspect of your preparation plan is to set up a system for tracking client information. This will help you keep track of who you’ve worked with, what services you’ve provided them, and when those services were provided.

Tracking client information can also help you identify potential tax issues. For example, if you’ve provided a client with several services over the past year, and they have a large amount of taxable income, you may want to suggest that they file their taxes sooner rather than later.

Having a system for tracking client information also makes it easier to provide your clients with year-end tax summaries. These summaries can include a breakdown of the services you provided them, as well as the total amount of taxes they paid.

Tracking client information is an important part of preparing your firm for tax season. By setting up a system for tracking client information, you can ensure that your firm is organized and ready to go.

Prepping for Tax Time

Prepping for tax time is something that every accounting and tax firm needs to do to make the most of this busy time of year. Remember to invest in some quality tax envelopes and folders to stay organized, update your software, and set up a system for tracking client information. By following this beginner’s guide, you can get your firm set up for the season.