The new year has presented a challenging opening chapter for Adobe, with the software giant’s stock facing pressure from a confluence of factors rather than a single negative event. Significant portfolio adjustments by major institutional investors, intensifying competition in the artificial intelligence arena, and a notable insider transaction have collectively dampened sentiment around the company.

Valuation Presents a Puzzle

A notable aspect of the current situation is Adobe’s valuation. Despite recent share price weakness, the stock is trading at a forward price-to-earnings (P/E) ratio of approximately 17.6. This level is considered below the company’s historical average and also sits beneath the typical valuation of many software sector peers. Some market observers suggest this could indicate the shares are appearing attractively valued relative to Adobe’s

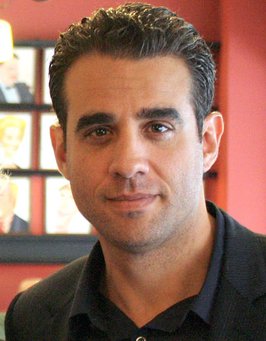

Insider Transaction Executed Under Pre-Arranged Plan

Recent regulatory filings have drawn investor attention. Adobe’s Chief Financial Officer, Daniel Durn, sold 1,646 shares on January 27 for a total value of roughly $485,323.

A critical detail accompanies this disclosure: the sale was conducted pursuant to a Rule 10b5-1 trading plan. These plans are established in advance to schedule transactions, specifically designed to shield corporate insiders from allegations of trading on material non-public information. The filing also noted that during the same reporting period, Mr. Durn received shares through the vesting of Restricted Stock Units and Performance Shares; a portion was automatically withheld to cover associated tax obligations.

Analyst Sentiment and AI Competition Weigh

On Wall Street, the prevailing tone at the start of the year has turned more guarded. Analyst commentary points to a “mixed to cautious outlook,” underscored by the fact that there have been three analyst downgrades for Adobe over the preceding 90 days. The core of this growing skepticism centers on growth concerns and heightened competitive pressures within the creative software market, particularly from new generative AI platforms.

Should investors sell immediately? Or is it worth buying Adobe?

For shareholders, the underlying market dynamic is key. Even if Adobe maintains a leadership position in numerous segments, the battle for dominance in design and collaboration software is escalating. The rapid growth of challengers like Figma is frequently cited as a prime example, visibly intensifying the fight for market share.

Key Data Points for Investors:

- Analyst Sentiment: Recently cautious, with 3 downgrades in the last 90 days.

- Primary Risk: Escalating competition from generative AI and fast-growing challengers.

- Current Valuation: Trading at a P/E of ~17.6, below historical and industry norms.

- Next Catalyst: The measurable contribution of Adobe’s own AI initiatives, such as Firefly, to future growth.

The price action tells a clear story: closing at $292.69 on Friday, Adobe’s stock is down roughly 12% year-to-date. This decline signals that the market is actively pricing in concerns regarding AI competition and growth sustainability.

All eyes now turn to the company’s upcoming earnings report. It will serve as the next critical test, revealing whether Firefly and related projects are tangibly driving revenue and momentum. The figures will determine if Adobe can counter the more skeptical narrative that has taken hold this year.

Ad

Adobe Stock: Buy or Sell?! New Adobe Analysis from February 2 delivers the answer:

The latest Adobe figures speak for themselves: Urgent action needed for Adobe investors. Is it worth buying or should you sell? Find out what to do now in the current free analysis from February 2.

Adobe: Buy or sell? Read more here...